ETH Price Prediction: Bullish Technicals Meet Strong Fundamentals Amid Market Crossroads

#ETH

- Technical Strength: ETH trading above 20-day MA with bullish MACD momentum suggests continued upward potential

- Fundamental Support: Institutional accumulation, DeFi dominance recovery, and AI financial applications provide strong foundation

- Risk Factors: Elevated leverage ratios and market volatility require careful position management

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

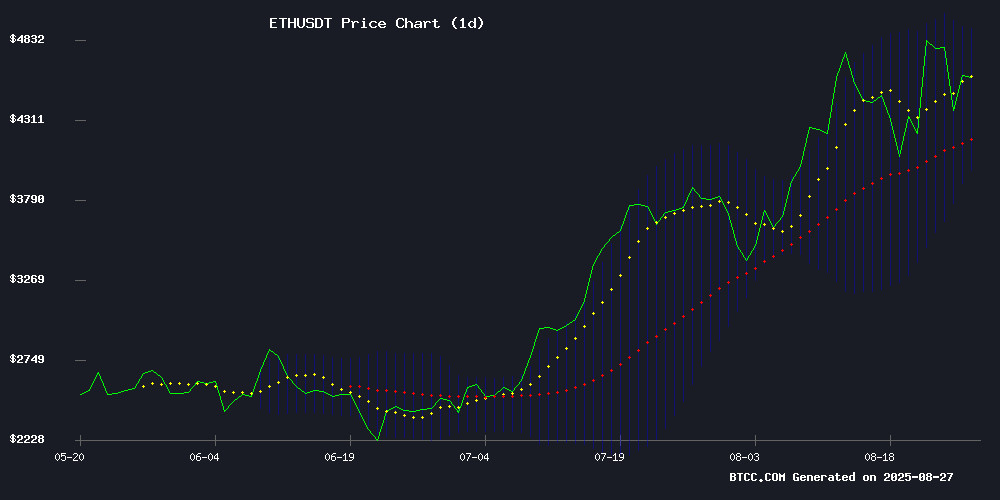

Ethereum is currently trading at $4,549.74, positioned above its 20-day moving average of $4,441.58, indicating underlying strength. The MACD indicator shows bullish divergence with the histogram at +145.57, suggesting growing positive momentum. Price action remains within the Bollinger Band range ($3,980.47-$4,902.69), with current levels hovering NEAR the middle band, indicating potential for upward movement toward the upper resistance.

According to BTCC financial analyst Ava, 'ETH's position above the 20-day MA combined with the improving MACD momentum creates a favorable technical setup. A break above $4,600 could trigger further gains toward the $4,900 resistance level.'

Market Sentiment: Mixed Signals Amid Institutional Accumulation and Leverage Concerns

Market sentiment for ethereum presents a complex picture with several competing narratives. Positive developments include substantial whale accumulation ($28 million), institutional expansion of ETH holdings by Bitmine, and Ethereum reclaiming DeFi dominance with 62% TVL market share. These are countered by concerns over Binance's record-high leverage ratios and high costs in Hong Kong's tokenization efforts.

BTCC financial analyst Ava notes, 'While institutional accumulation and DeFi dominance are fundamentally bullish, the elevated leverage ratios warrant caution. The market appears to be at a crossroads where strong fundamentals are tempered by technical overextension risks.'

Factors Influencing ETH's Price

Polymarket Bets Surge as Taylor Swift Engagement Sparks Crypto Gambling Interest

Global pop icon Taylor Swift's engagement announcement to NFL star Travis Kelce has unexpectedly rippled through crypto markets, triggering a flurry of activity on prediction platform Polymarket. The event, which captivated Swift's massive fanbase, saw betting volumes exceed $385,000 in related markets.

Notably, a user named "romanticpaul" made aggressive bets starting August 25, 2025, nearly doubling the implied probability of Swift's engagement from 25% to 45% within hours. Crypto sleuths speculate the account might belong to Paul Sidoti, Swift's longtime guitarist, though this remains unconfirmed.

The incident highlights how celebrity news increasingly intersects with decentralized prediction markets. Polymarket's ETH-based platform demonstrated surprising liquidity for pop culture events, with Swift's romantic status moving markets more dramatically than many altcoin listings.

Ethereum MVRV Surge Signals Market Crossroads Amid $4.5K Price Hold

Ethereum's market dynamics reveal a tension between euphoria and caution as its MVRV ratio breaches 2.10. The metric, now at 2.5 following an 8% retreat from its $4.9K all-time high, historically precedes local tops. Derivatives markets show $10 billion in Leveraged positions unwound over three days—a classic deleveraging pattern after excessive speculation.

March 2024's precedent looms large: ETH plummeted 50% within seven weeks when MVRV last peaked at 2.35. Current on-chain data mirrors that overheated state, with Open Interest dropping 7% in a single session. The August 25th 10% price slide wasn't anomalous but symptomatic of a market where unrealized gains exceed 2x for most holders.

FOMO now battles with liquidation risks as ETH oscillates NEAR $4,500. Two August spikes above the critical 2.10 MVRV threshold suggest retail momentum could either fuel another leg up or accelerate profit-taking. Glassnode's charts depict a fractal of past cycles—sharp rallies followed by violent corrections before accumulation resumes.

Succinct Partners with Offchain Labs’ Tandem to Bring ZK Proving to Arbitrum

Succinct, a zero-knowledge infrastructure platform built on Ethereum, has entered a strategic partnership with Tandem, a venture studio under Offchain Labs. The one-year collaboration aims to integrate zero-knowledge proofs into Arbitrum's ecosystem, enhancing security, scalability, and interoperability for its rollup chains.

The MOVE signals strong confidence in Succinct's Prover Network, which specializes in verifiable computing through ZK technology. By enabling fast finality and trustless validation, the partnership could redefine Arbitrum's infrastructure for decentralized applications.

ZK proofs allow one party to prove computational integrity without revealing underlying data—a critical advancement for blockchain privacy and efficiency. This development positions Arbitrum at the forefront of Layer 2 innovation as demand for scalable Ethereum solutions grows.

Ethereum Price Forecast: Standard Chartered Sees Pullback as Buying Opportunity

Ethereum surged 5% on Tuesday after Standard Chartered analysts labeled its recent pullback from all-time highs as a prime buying opportunity. Geoffrey Kendrick, the bank's global head of digital asset research, noted ETH's dip toward $4,500 offers a "great entry point," maintaining a year-end target of $7,500.

Institutional demand continues to fuel Ethereum's momentum. Digital asset treasuries (DATs) and U.S. spot ETH ETFs have collectively absorbed 4.9% of circulating supply since June. "These inflows are just getting started," Kendrick emphasized, projecting DATs alone could eventually hold 10% of ETH's circulation.

Technical factors support the bullish case. ETH must hold above a rising trendline to maintain its upward structure after Sunday's record high at $4,955. The asset currently trades at $4,580, with analysts highlighting sustained accumulation by institutional products as a key price driver.

Dormant Ethereum Whale Resurfaces with $28 Million Accumulation

A previously inactive ethereum wallet holding 6,334 ETH ($28.08 million) reemerged this week after a three-year dormancy, withdrawing its entire balance from Kraken exchange. Blockchain analysts interpret the timing—coinciding with ETH's recent pullback—as a strategic accumulation move rather than a liquidation signal.

Institutional demand appears to be accelerating across the ecosystem. BitMine's weekly ETH purchases totaled $252 million, while Bitstamp recorded a separate 20,000 ETH transfer to private custody. These exchange-to-wallet movements typically indicate long-term holding strategies that reduce available supply on trading platforms.

Technical charts reveal a developing V-shaped recovery pattern mirroring previous cycle bottoms. The last two instances of this formation preceded ETH price surges of 297% (2020) and 1,024% (2016), according to historical data from CryptoGoos Analytics.

The Rise of DeFi: A Blockchain-Powered Alternative to Traditional Finance

Decentralized finance (DeFi) has emerged as a formidable challenger to traditional financial systems, fueled by growing distrust in centralized institutions. Built on blockchain technology, DeFi enables peer-to-peer transactions through smart contracts, eliminating intermediaries while offering familiar services like lending, borrowing, and trading.

The sector's explosive growth is undeniable—total value locked (TVL) skyrocketed from $800 million in January 2020 to $148.99 billion at press time. This vertical ascent underscores crypto's relentless innovation, with Ethereum-based protocols leading the charge in reshaping global finance.

Unlike traditional finance's gatekept systems, DeFi operates on transparent, permissionless networks. The ecosystem thrives on composability, where protocols like lending markets and decentralized exchanges interoperate seamlessly. Market dynamics suggest institutional interest is accelerating, particularly in yield-bearing instruments and institutional-grade liquidity solutions.

Ethereum Emerges as Foundation for AI-Driven Financial Systems

Ethereum's dominance in stablecoins, decentralized finance, and tokenization positions it as the infrastructure likely to power trillion-dollar AI financial flows. The blockchain's adaptability is proving crucial as artificial intelligence becomes embedded across software ecosystems.

The proposed ERC-8004 standard marks a pivotal development, creating pathways to integrate AI capabilities directly into Ethereum's architecture. This symbiotic relationship enhances ETH's utility while opening new frontiers for AI applications.

Industry observers anticipate the emergence of decentralized AI marketplaces on Ethereum, where specialized agents could be deployed for tasks ranging from legal analysis to code auditing. Such developments would cement Ethereum's role as the settlement LAYER for AI-powered financial services.

Bitmine Expands Ethereum Holdings Amid Market Volatility

Ethereum maintains its position above $4,400 following a weekend surge that briefly propelled it to record highs. Institutional demand and market Optimism initially drove the rally, though prices have since retraced slightly. Analysts remain divided on ETH's next move, with some viewing the current support level as a springboard toward $5,000, while others caution against potential exhaustion among buyers.

Bitmine, Ethereum's largest corporate holder, has added 4,871 ETH worth $21.28 million to its treasury, bringing its total holdings to $7.65 billion. This aggressive accumulation by institutional players highlights growing confidence in ETH's long-term value proposition. Market watchers are now closely monitoring whether Ethereum can sustain its momentum or face a deeper correction.

The altcoin market's trajectory may hinge on ETH's ability to break into uncharted territory. Whale activity and institutional participation continue to shape the narrative, with blockchain analytics firm Lookonchain tracking these high-stakes movements in real time.

Ethereum Faces Risk As Binance Leverage Ratio Skyrockets To Record Levels

Ethereum stands at a critical juncture following a week of intense volatility. A Friday surge to new highs was swiftly countered by Monday's sharp sell-off, leaving ETH testing the $4,400 support level. Bulls view this as a make-or-break zone for maintaining upward momentum toward $5,000, while bears see vulnerability for further downside.

Market structure appears increasingly fragile as Binance's Estimated Leverage Ratio for ETH hits unprecedented levels. Analyst Darkfost warns this derivatives overheating could trigger violent price swings. When leveraged positions reach extremes, forced liquidations often amplify market moves in both directions.

The convergence of technical precariousness and speculative excess makes Ethereum's near-term trajectory particularly sensitive. Traders face heightened risk of whipsaw action as the market digests these competing forces at a pivotal technical level.

Hong Kong's RWA Tokenization Push Faces High Costs Despite Growing Investor Interest

Hong Kong's VIRTUAL asset ETFs recorded HK$56.4 million ($7.2 million) in trading volumes on August 26, signaling sustained demand despite market volatility. The figures highlight the city's emerging role in real-world asset (RWA) tokenization, though structural barriers remain formidable.

Tokenizing a single RWA product in Hong Kong costs over RMB 6 million ($820,000), with brokerage fees constituting the largest expense. Blockchain integration, legal compliance, and cross-border approvals create additional layers of cost. Licensing presents another hurdle—a basic financial license exceeds RMB 1.5 million, while virtual asset service provider permits can cost tens of millions.

Ethereum-based products dominate ETF flows, suggesting institutional preference for established blockchain infrastructure. Liquidity appears concentrated in tokenized money market funds and US Treasuries, while illiquid assets struggle to gain traction. Proponents argue tokenization improves upon traditional securitization, but reliance on oracles and lack of specialized expertise continue to hinder adoption.

Ethereum Reclaims DeFi Crown with 62% TVL Dominance

Ethereum has solidified its position as the dominant force in decentralized finance, now commanding 62% of the total value locked across DeFi protocols. On-chain analytics firm Sentora reports a steady climb in Ethereum's market share since April, with $92 billion currently parked in its smart contracts—nearly two-thirds of the sector's $150 billion ecosystem.

The resurgence stems partly from booming liquid staking platforms like Lido, which allow ETH holders to earn yields while maintaining liquidity through derivative tokens. This niche now accounts for a significant portion of Ethereum's TVL growth.

Ethereum's renewed dominance coincides with ETH trading near $4,500, though questions remain whether competitors can erode its lead with cheaper, faster alternatives.

Is ETH a good investment?

Based on current technical indicators and market developments, Ethereum presents a compelling investment opportunity with measured risk. The cryptocurrency is trading above its key 20-day moving average with bullish MACD momentum, while fundamental factors including institutional accumulation, DeFi dominance recovery, and emerging AI financial applications provide strong support.

However, investors should remain aware of near-term risks including elevated leverage ratios and potential volatility. The current price level around $4,550 offers a reasonable entry point for long-term investors, with potential resistance around $4,900 and support near $3,980.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $4,549.74 | Neutral |

| 20-day MA | $4,441.58 | Bullish |

| MACD Histogram | +145.57 | Bullish |

| Bollinger Position | Middle Band | Neutral |

| Support Level | $3,980.47 | Strong |

| Resistance Level | $4,902.69 | Key |